You are viewing the article Warren Buffett at Tnhelearning.edu.vn you can quickly access the necessary information in the table of contents of the article below.

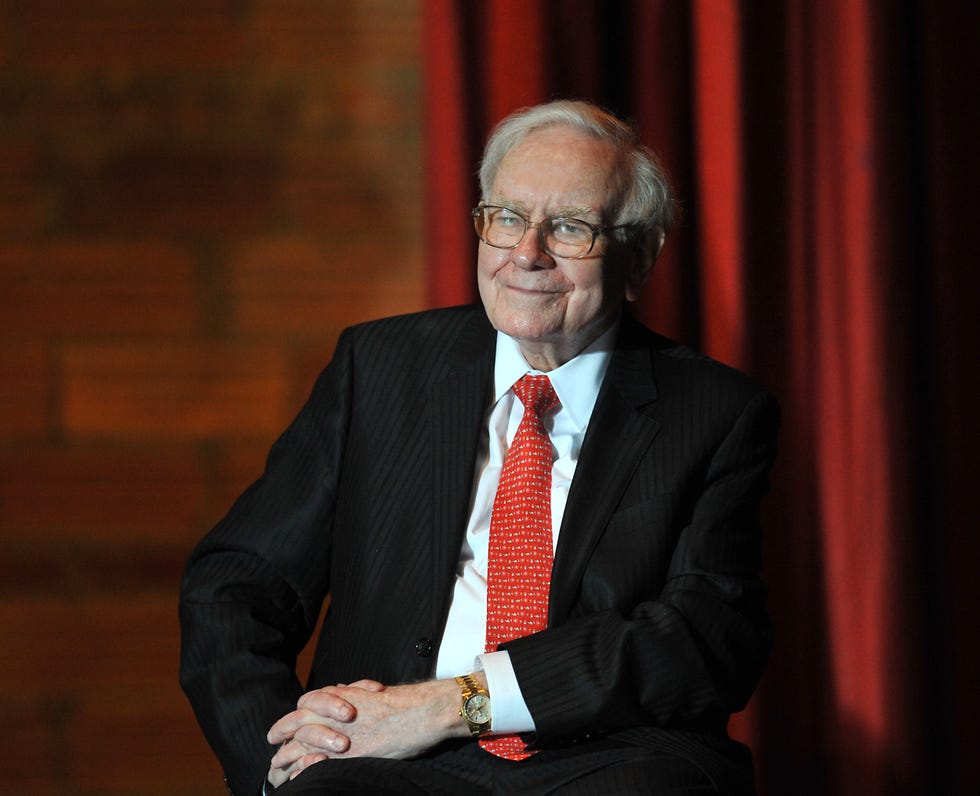

(1930-)

Who Is Warren Buffett?

Warren Buffett demonstrated keen business abilities at a young age. He formed Buffett Partnership Ltd. in 1956, and by 1965 he had assumed control of Berkshire Hathaway. Overseeing the growth of a conglomerate with holdings in the media, insurance, energy and food and beverage industries, Buffett became one of the world’s richest men and a celebrated philanthropist.

Early Life

Warren Edward Buffett was born on August 30, 1930, in Omaha, Nebraska. Buffett’s father, Howard, worked as a stockbroker and served as a U.S. congressman. His mother, Leila Stahl Buffett, was a homemaker. Buffett was the second of three children and the only boy. He demonstrated a knack for financial and business matters early in his childhood: Friends and acquaintances have said the young boy was a mathematical prodigy who could add large columns of numbers in his head, a talent he occasionally demonstrated in his later years.

Buffett often visited his father’s stock brokerage shop as a child and chalked in the stock prices on the blackboard in the office. At 11 years old he made his first investment, buying three shares of Cities Service Preferred at $38 per share. The stock quickly dropped to only $27, but Buffett held on tenaciously until it reached $40. He sold his shares at a small profit but regretted the decision when Cities Service shot up to nearly $200 a share. He later cited this experience as an early lesson in patience in investing.

First Entrepreneurial Venture

By the age of 13, Buffett was running his own businesses as a paperboy and selling his own horseracing tip sheet. That same year, he filed his first tax return, claiming his bike as a $35 tax deduction. In 1942 Buffett’s father was elected to the U.S. House of Representatives, and his family moved to Fredricksburg, Virginia, to be closer to the congressman’s new post. Buffett attended Woodrow Wilson High School in Washington, D.C., where he continued plotting new ways to make money. During his high school tenure, he and a friend purchased a used pinball machine for $25. They installed it in a barbershop, and within a few months, the profits enabled them to buy other machines. Buffett owned machines in three different locations before he sold the business for $1,200.

Education

Buffett enrolled at the University of Pennsylvania at the age of 16 to study business. He stayed two years, moved to the University of Nebraska to finish up his degree, and emerged from college at age 20 with nearly $10,000 from his childhood businesses.

In 1951 he received his master’s degree in economics at Columbia University, where he studied under economist Benjamin Graham and furthered his education at the New York Institute of Finance.

Influenced by Graham’s 1949 book, The Intelligent Investor, Buffett sold securities for Buffett-Falk & Company for three years, before working for his mentor for two years as an analyst at Graham-Newman Corp.

Berkshire Hathaway

In 1956 Buffet formed the firm Buffett Partnership Ltd. in his hometown of Omaha. Utilizing the techniques learned from Graham, he was successful in identifying undervalued companies and became a millionaire. One such enterprise Buffett valued was a textile company named Berkshire Hathaway. He began accumulating stock in the early 1960s, and by 1965 he had assumed control of the company.

Despite the success of Buffett Partnership, its founder dissolved the firm in 1969 to focus on the development of Berkshire Hathaway. He phased out its textile manufacturing division, instead expanding the company by buying assets in media (The Washington Post), insurance (GEICO) and oil (Exxon). Immensely successful, the “Oracle of Omaha” even managed to spin seemingly poor investments into gold, most notably with his purchase of scandal-plagued Salomon Brothers in 1987.

Following Berkshire Hathaway’s significant investment in Coca-Cola, Buffett became director of the company from 1989 until 2006. He has also served as director of Citigroup Global Markets Holdings, Graham Holdings Company and The Gillette Company.

Later Activity and Philanthropy

In June 2006 Buffett made an announcement that he would be giving his entire fortune away to charity, committing 85 percent of it to the Bill and Melinda Gates Foundation. This donation became the largest act of charitable giving in United States history. In 2010 Buffett and Gates announced they had formed The Giving Pledge campaign to recruit more wealthy individuals for philanthropic causes.

In 2012 Buffett disclosed that he had been diagnosed with prostate cancer. He began undergoing radiation treatment in July, and successfully completed his treatment in November.

The health scare did little to slow the octogenarian, who annually ranks near the top of the Forbes world billionaires list. In February 2013 Buffett purchased H. J. Heinz with private equity group 3G Capital for $28 billion. Later additions to the Berkshire Hathaway stable included battery maker Duracell and Kraft Foods Group, which merged with Heinz in 2015 to form the third-largest food and beverage company in North America.

In 2016 Buffett launched Drive2Vote, a website aimed at encouraging people in his Nebraska community to exercise their right to vote, as well as to assist in registering and driving voters to a polling location if they needed a ride.

A vocal supporter of Democratic presidential nominee Hillary Clinton, whom he’d endorsed in 2015, Buffett also challenged the Republican nominee, Donald Trump, to meet and share their tax returns. “I will meet him in Omaha or Mar-a-Lago or, he can pick the place, anytime between now and election, he said at an August 1 rally in Omaha. “I’ll bring my return, he’ll bring his return. We’re both under audit. And believe me, nobody’s going to stop us from talking about what’s on those returns.” Trump did not accept the offer, though his refusal to share his returns ultimately did not prevent his election to the presidency in 2016.

In May 2017 Buffett revealed that he had begun selling some of the approximately 81 million shares he owned in IBM stock, noting that he did not value the company as highly as he did six years earlier. Following another sale in the third quarter, his stake in the company dropped to about 37 million shares. On the flip side, he increased his investment in Apple by 3 percent and became Bank of America’s largest shareholder by exercising warrants for 700 million shares. Early the following year, he added more Apple shares to make it Berkshire Hathaway’s largest common stock investment.

Between 2006 and 2017, Buffett gave away close to $28 billion in charity, according to a report by USA Today.

Healthcare Venture

On January 30, 2018, Berkshire Hathaway, JPMorgan Chase and Amazon delivered a joint press release in which they announced plans to team up and form a new healthcare company for their U.S. employees.

According to the release, the company would be “free from profit-making incentives and constraints” as it tried to find ways to cut costs and improve the overall process for patients, with an initial focus on technology solutions.

Calling the swelling costs of healthcare a “hungry tapeworm on the American economy,” Buffett said, “We share the belief that putting our collective resources behind the country’s best talent can, in time, check the rise in health costs while concurrently enhancing patient satisfaction and outcomes.”

In March outlets reported that Berkshire Hathaway’s HomeServices of America Inc., the second-largest residential brokerage owner in the U.S., was set to take more steps toward the top spot, held by Realogy’s NRT LLC. Buffett said he “barely noticed” when Berkshire Hathaway originally acquired HomeServices, then part of MidAmerican Energy Holdings Co., back in 2000.

Buffett returned to the news in spring 2020 with the announcement that Berkshire Hathaway had dumped its holdings in the “big four” airlines — Southwest, American, Delta and United — over concerns that the industry would never fully recover from the coronavirus pandemic.

Personal Life

In 2006 Buffett, at age 76, married his longtime companion Astrid Menks.

Buffett was previously married to his first wife Susan Thompson from 1952 until her death in 2004, although the couple separated in the 1970s. He and Susan had three children: Susan, Howard and Peter.

QUICK FACTS

- Birth Year: 1930

- Birth date: August 30, 1930

- Birth State: Nebraska

- Birth City: Omaha

- Birth Country: United States

- Gender: Male

- Best Known For: Known as the “Oracle of Omaha,” Warren Buffett is an investment guru and one of the richest and most respected businessmen in the world.

- Industries

- Business and Industry

- Astrological Sign: Virgo

- Schools

- University of Pennsylvania

- Woodrow Wilson High School

- University of Nebraska

- Columbia University

Fact Check

We strive for accuracy and fairness.If you see something that doesn’t look right,contact us!

CITATION INFORMATION

- Article Title: Warren Buffett Biography

- Author: Biography.com Editors

- Website Name: The Biography.com website

- Url: https://www.biography.com/business-leaders/warren-buffett

- Access Date:

- Publisher: A&E; Television Networks

- Last Updated: May 27, 2021

- Original Published Date: April 3, 2014

QUOTES

- You can’t make a baby in a month if you get nine women pregnant.

- My kids are going to carve out their own place in this world, and they know I’m for them whatever they want to do.

- It’s a lot easier to buy things sometimes than it is to sell them.

- Rule number one: Never lose money. Rule number two: Never forget rule number one.

- I made my first investment at age 11. I was wasting my life up until then.

- It is impossible to unsign a contract, so do all your thinking before you sign.

- It’s easier to stay out of trouble than it is to get out of trouble.

- You should invest like a Catholic marries—for life.

- Wall Street is the only place that people ride to in a Rolls-Royce to get advice from those who take the subway.

- If calculus or algebra were required to be a great investor, I’d have to go back to delivering newspapers.

- Price is what you pay. Value is what you get.

- The dumbest reason in the world to buy a stock is because it’s going up.

- Never ask a barber if you need a haircut.

- Risk comes from not knowing what you’re doing.

- You couldn’t advance in a finance department in this country unless you taught that the world was flat.

- After all, you only find out who is swimming naked when the tide goes out.

- You are neither right nor wrong because the crowd disagrees with you. You are right because your data and reasoning are right.

- Someone’s sitting in the shade today because someone planted a tree a long time ago.

- I feel great… and my energy level is 100 percent.

Thank you for reading this post Warren Buffett at Tnhelearning.edu.vn You can comment, see more related articles below and hope to help you with interesting information.

Related Search: