You are viewing the article 9 Best Apps like Klarna that Support Most Brands (2022) at Tnhelearning.edu.vn you can quickly access the necessary information in the table of contents of the article below.

If over 20 million Klarna users can’t convince you to use the service, I don’t think anything else can. Klarna is available in multiple regions, but we have other great apps that work similarly.

In fact, multiple apps before Klarna introduced the buy now, pay later service. So, what other services should you know about? The article focuses on the 9 best apps like Klarna.

Afterpay

Availability: US, Canada, Australia, New Zealand, UK, France, and Spain

Expected limit: $350

Credit check: Soft Check (Checks for minimum payment before a purchase – It does not inform credit authorities)

Late fee: $10 (can be up to 25% of the order)

Afterpay is the direct competitor of Klarna. Supporting over 17,000 stores just in the U.S, Afterpay is the all-in-one service for your buy now, pay later needs. The expected initial limit is $350, but as you pay on time, it increases.

Initially, you get 6 weeks to pay where the first payment is before the purchase. When your credibility increases, the company gives you up to a $2,000 limit and 8 weeks to pay.

Afterpay uses a digital card method, where you generate one in the Afterpay app and add it to your digital wallet (Google or Apple Pay). The card can be used on the participant stores, but you must activate it in the app to use it.

Zip Pay & QuadPay

Availability: US, Canada, Australia, New Zealand, and the UK

Expected limit: $350 to 1,000

Credit check: Soft Check (Checks for minimum payment but does not inform credit authorities)

Late fee: ZipPay has no late fee; it charges $7.95 per month if the account is not cleared. QuadPay has a $7 late fee.

The next app like Klarna is ZipPay. It is available as ZipPay in all nations now. It used to be known as QuadPay in the US and Canada before. It uses the simple procedure of four equal fortnightly payments.

The unique thing about Zip is that you can use the card in most stores accepting Visa (the most popular payment provider in the US). All you have to do is generate the card in the app, add it to the wallet, and start using it online and in stores.

The initial limit of ZipPay is between $350 and $1,000, but it goes to $1,500 after some on-time repayments. Like other buy now, pay later apps, the company does not perform a hard credit check.

Related: Afterpay vs. QuadPay

Sezzle

Availability: US and Canada

Expected limit: $500

Credit check: Soft check (Checks for minimum payment but does not inform credit authorities)

Late fee: $10

Sezzle is available in the US and Canada, and it uses a simple approach like Klarna. You pay the first payment on the purchase day, and the rest three are every fortnight.

According to the website, over 47,000 stores support Sezzle as a payment method. However, if you go to the search bar, it shows only 9,000.

Similar to Klarna, you pay in four equal installments over the period of 6 weeks without paying any interest. Sezzle offers both in-store and online payment options.

Related: Afterpay vs. Sezzle

PayPal Pay in 4

Availability: US, Australia, and others

Limit: Unknown

Credit check: Soft check (Checks for minimum payment but does not inform credit authorities)

Late fee: Unknown

PayPal’s new feature called Pay in 4 is an easy way to send money and shop in your favorite stores. It’s one of the best apps like Klarna, offering both full and split payment options.

PayPal already has an edge because over 7 million sites accept PayPal. Also, the Pay in 4 system works while sending money for goods.

The service is new; hence it’s not available everywhere, and the limit and credit checks are unknown, but we will see more of this service soon.

Related: Klarna vs. PayPal

Affirm

Availability: US, Canada, and Australia

Expected limit: $500 – $3,000

Credit check: Soft and hard checks (depending on the selected option)

Late fee: No late fee (it affects the account’s credibility)

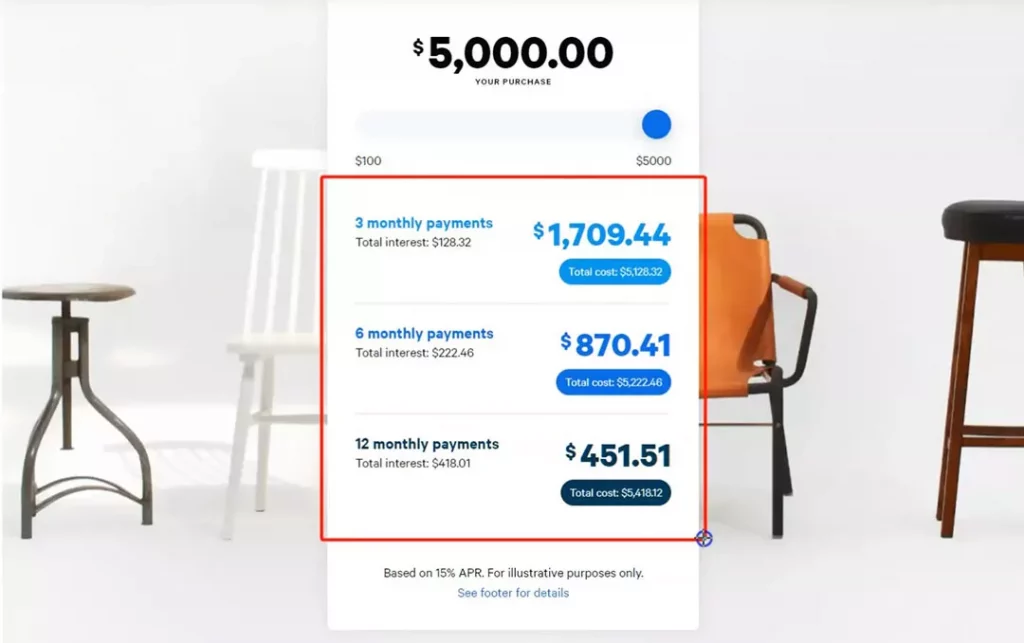

Affirm approach is like ZipPay. It allows generating a Visa card that works about everywhere where Visa is accepted. The basic Affirm option has a fortnight feature with automatic payments, but if you can’t make the fortnightly payments, you can go with the monthly option.

The monthly feature is for big purchases giving you up to 12 months to pay. However, one must be aware that it charges interest.

The website comes with a calculator which shows how much you will be paying in a certain time period. Affirm is one of the popular buy now, pay later apps making it one of the best apps like Klarna.

PayBright

Availability: Canada

Expected limit: $500 – $2,000

Credit check: Soft and hard checks (depending on the selected option)

Late fee: None

PayBright is part of Affirm, but it’s only available in Canada. It takes a similar strategy of giving you two options to pay.

You can use the Pay in 4 method to pay in 6 weeks, or you can choose the monthly installment system to take more time to pay.

Splitit

Availability: Canada

Expected limit: $500 – $2,000

Credit check: Soft and hard checks (depending on the selected option)

Late fee: None

A new payment processing service is Splitit. It allows you to choose the installment period and does not charge any late fee or any interest.

The way it works is you choose Splitit at the checkout and choose your plan. Once the item is purchased, you are good to go.

For installments, if you don’t have sufficient funds they send emails and try the payment method again. You can manage your account on the website.

Sunbit

Availability: US

Expected limit: Up to $10,000

Credit check: Soft and hard checks

Late fee: No late fee, but interest applies if the account is unpaid

The second last Klarna alternative is Sunbit. It takes the high road of giving you up to 12 months to pay. You choose the payment plan to suit your needs.

It checks your credit history before giving you any limit, but you can get up to $10,000 to shop in stores. It does not charge any late fee, but you pay the interest if you miss a payment.

Zip Money

Availability: Australia and New Zealand

Expected limit: $1,000 to $5,000

Credit check: Soft and hard checks

Late fee: $7.95 monthly + interest on the remaining balance

Zip’s approach to handling big transactions is Zip Money. Unlike Zip, its starting limit is $1,500, but you can score up to $5,000. It works similar to Zip and can be used online and in-store where Visa is available.

There are a couple of things one must know before using this service. Zip Money affects your credit score if you don’t pay on time. Also, you pay interest on purchases and the monthly fee, so there is much to consider before signing up for Zip Money.

Apps Like Klarna: Conclusion

Klarna is popular, especially in Europe, but it’s a bit complex. This is where those 9 apps like Klarna come into play.

I hope the article helped you to decide. Please let me know your thoughts in the comments below and subscribe to the newsletter for future updates.

Thank you for reading this post 9 Best Apps like Klarna that Support Most Brands (2022) at Tnhelearning.edu.vn You can comment, see more related articles below and hope to help you with interesting information.

Related Search: