You are viewing the article 5 effective personal spending management methods for beginners at Tnhelearning.edu.vn you can quickly access the necessary information in the table of contents of the article below.

If you are struggling in managing expenses, please refer to the following article!

What is expense management?

You can understand spending management is knowing how to divide your money into reasonable amounts to use. This is an extremely important step to your independence and financial freedom.

Only by managing your expenses can you be financially independent

Only by managing your expenses can you be financially independent

You will be less stressed about money when you know how to manage it early. Besides, when you understand how to effectively manage your spending, you can easily achieve the goals you intend in the future, instead of being stagnant and holding back.

5 effective ways to manage spending

Effective cost management methods

Effective cost management methods

Pay yourself first (Pay yourself first)

With this method, you will deduct an amount, at least 10% of your income, into a savings fund. That is to pay yourself first. As for the rest of the money, you can spend it comfortably because you have already saved some money in your pocket first.

This is an easy method to do. Anyone can do it even if you are not interested in money management.

Prioritize yourself first!

Prioritize yourself first!

The advantage of this method is that it is simple, easy to use, and less time consuming . The only downside is that you don’t have to invest to make a profit because you only have enough money, nothing more and nothing less.

The 50/30/20 . Rule

This is a well-known rule of spending management for beginners. With this method, you will divide your income into 3 amounts with the following ratio:

– 50% of spending on essential things such as rent, food, electricity, water,…

– 30% for other desired spending such as travelling, shopping, entertainment,…

– 20% of spending on savings and to repay debt.

See more: Instructions on how to calculate domestic water bills simply and accurately

The 50/30/20 method is quite popular

The 50/30/20 method is quite popular

This is a fairly common method because it is quite easy to remember and can be applied immediately. You have a separate account for entertainment too.

Like the Pay Yourself First method, this method cannot grow your money and only protects you in emergencies. You will have to make some adjustments if at times you need more than 50% of your essential expenses.

Cover letter method

This method is quite rigorous

This method is quite rigorous

This is a cash-only method and paper envelopes. The steps are as follows:

– List important expenses each month and set a budget for each. For example, house rent 3 million, food and drink 2 million, …

– Withdraw cash when receiving income and divide the amount into each envelope as planned.

– When spending any money, just get the right cover letter.

– You are not allowed to spend on it when the cover letter is empty. You are only allowed to spend when you receive the next month’s income.

This method helps you be more persistent and spend more carefully, especially for those who are “overstretched” or in debt . Therefore, this method helps you save money and quickly get out of debt.

Method 6 vials

This method is quite confusing for beginners

This method is quite confusing for beginners

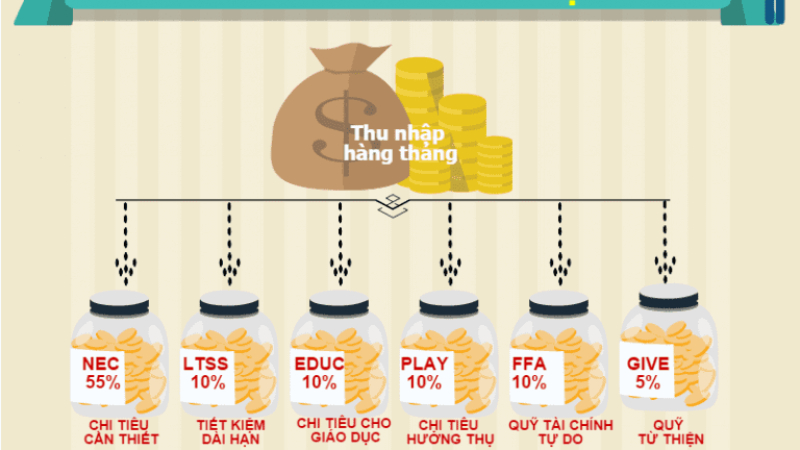

This is T.Harv Eker’s method of dividing his income into 6 accounts in the book “Secrets of the Millionaire Mind”. Here’s how to divide the 6 jars:

– Necessity bottle (NEC) 55%: Expenses for essential needs.

– Play bottle (PLAY) 10%: Spending to satisfy your own pleasure.

– Education jar (EDU) 10%: Spending for the development of your own thinking, knowledge and skills.

– Giving bottle (GIV) 5%: Spending for charity, helping people who have difficulties in life.

– Savings to spend for the future (LTSS) 10%: Save money to travel, buy a house, buy a car,…

– Financial freedom jar (FFA) 10%: This amount is for business, investing your own money.

The advantage of this method is that you have an amount to grow your income without affecting your current life. This method is also clear because your earnings are divided into 6 separate jars.

The difficulty of this method is that you have to keep a close eye on it to see if you are spending within the prescribed limit or not. Also because there are many jars, it will be a bit messy.

10/20/70 . method

This method is new!

This method is new!

This is a method drawn from 3 methods of 50/30/20, 6 jars and Pay Yourself First. Basically you will divide your income into 3 amounts:

– 10% savings: In this account, you will focus on the emergency fund first, then the long-term savings.

– 20% for personal development to have more business, investment opportunities or have more beneficial relationships for your work.

– 70% for daily expenses as well as money for entertainment, entertainment, …

This is a pretty good method because it is drawn from 3 methods of 50/30/20, 6 jars and Pay Yourself First. You don’t need to meticulously track daily spending, can grow your income, not too messy.

So Tnhelearning.edu.vn has revealed to you 5 effective personal spending management methods for beginners. Hopefully through the above article, you will have your own effective spending method!

See more:

>> Tips to save electricity when using infrared cookers

>> Cost saving tips when buying baking tools

>> Tips to save electricity when using microwaves

Good experience Tnhelearning.edu.vn

Thank you for reading this post 5 effective personal spending management methods for beginners at Tnhelearning.edu.vn You can comment, see more related articles below and hope to help you with interesting information.

Related Search: